The stock market has turned in its strongest quarter of the year so far despite the Fed’s recent quarter point increase in short-term interest rates. We had a profitable quarter. Our stock picking skills are intact as we are running ahead of the median stock in the S&P 500 Index by nearly a full percent. But the index itself is up by more because it is a capitalization-weighted index and a few big growth stocks account for a huge chunk of the gain. It is hard to feel like a prudent investor while concentrating too heavily in just a few stocks – so we’re ahead of the median but behind the average. All in all, a good quarter and a good year so far.

We try very hard to customize portfolios for individual clients and we can certainly give you a more concentrated portfolio. But we don’t think it is advisable or particularly prudent. For example, people who owned too much Facebook in an effort to match or beat the index got clobbered this quarter as the stock dropped from 218 to 166 in three days. We think it makes sense to be well diversified – that usually pays off in absolute returns and certainly pays off in risk-adjusted returns. But if your goal is to “beat the market”, it likely means buying more Apple and Amazon. Both are great companies; we just don’t want to be over-concentrated in them even though there is an unusual degree of mega-cap stock influence on the indices right now.

A few salient points:

- The US market continues to outpace foreign markets. Foreign exposure put a very modest dent in our overall performance. Although over the long term it makes sense to have a bit of diversification, we have significantly reduced our exposure to emerging markets.

- We have seen revenue growth as well as earnings growth, which suggests that the rally is not simply a function of the tax cuts.

- Corporate buybacks of stock have also played a large role, and are at record levels.

- While many stocks are richly valued, there are certainly many areas of reasonable value.

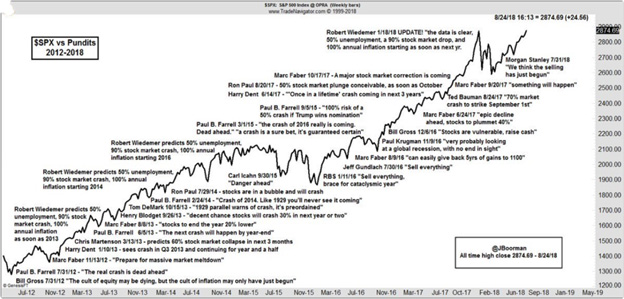

- If you subscribe to the notion that the market climbs the proverbial “wall of worry”, there are plenty of warnings out there as a graph below illustrates.

Harry Truman once said he wanted to meet a one-handed economist because he could get a firm point of view rather than someone who always hedged with “on the other hand”. But there are always countervailing considerations. Interest rates are rising and are likely to continue upward on a deliberate trajectory at least through next spring. This is not new news and should be largely discounted in current prices. Many corporations have started to issue more cautious statements around future earnings. Trade issues are clearly a risk, though the market seems confident so far in President Trump’s ability to negotiate favorable terms for the home team without provoking an all-out trade war. Finally, the November elections could change the balance of power in Washington and change psychology as well. But if the Democrats take just the House, it would mean no new Trump economic initiatives but it won’t mean any repeal of existing ones such as reduced taxes or regulatory burdens.

It is also worth a look at market internals. Growth stocks continue to outpace value stocks by an unusual margin, perhaps best shown by the following graph:

It is unusual for growth stocks to have such a large performance edge. It may be that value stocks will not outperform until the next down cycle when their valuations and dividend yields provide some cushion. At the same time, growth stocks can decline sharply because a decline or even deceleration in earnings growth can cause a contraction of PE ratios – thus providing a double whammy on the down side. That why we take steps to limit our risk in growth stocks, even at the cost of sometimes foregoing some upside. This has helped somewhat as computer chip stocks have softened due to fears of a trade war.

We have started to accumulate a few value stocks. AT&T has a market cap of about $240 billion and an enterprise value of about $420 billion. When the stock sunk to a level that produced a dividend yield of 6.xx on the stock, it struck us as a compelling value. The market punished the stock after AT&T paid a huge premium to acquire Time Warner for $85 billion. But now the AT&T umbrella includes Warner Brothers, HBO, CNN, and DirecTV as well as over 150[1] million wireless subscribers – both pipes and content. And don’t forget wirelines. So it is not going anywhere anytime soon and even if the stock price does not go up (it has since our purchase), we get paid over 6% for holding it. And some perspective – AOL paid $165 billion to acquire Time Warner back in 2000, so in inflation-adjusted dollars, AT&T bought it for about a third of that price. The stock is this cheap for two reasons. First, it has an overhang of $190 billion in debt. Second, some of its assets are perceived as wasting assets in the new world of content given competition from the likes of Netflix and Amazon. But by most metrics, the stock is quite cheap; its PE ratio is under 10. As earnings have climbed, the dividend payout ratio moved to market norms after having been too high.

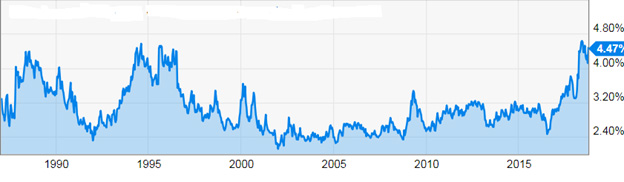

Our other major foray into value stock territory is the purchase of General Mills. The stock has rarely offered a dividend yield this high in the past 30 years, as shown here:

Its well-known brands include Wheaties, Cheerios, Total, Betty Crocker, Häagen-Dazs, Bisquick, Yoplait, Progresso, and Old El Paso. Organic net sales are relatively flat but the company has acquired some faster growing brands; they have increased their debt load by 50% in so doing. Even so, cash flow covers interest 9-fold and earnings cover the current 4.5% dividend yield with a comfortable payout ratio that has ranged between 51% and 70% in the past three years. It’s not going to double or triple, but should offer a solid, stable return over time.

Companies in the S&P 500 Index repurchased $347 billion of their own shares in the first two quarters of 2018, a record pace on track to $700 billion this year. TrimTabs Investment Research, which tracks all the buyback transactions, estimated that the total repurchases for all US companies could reach $1 trillion this year, a new record. To put that in some context, the market cap of all S&P 500 companies is about $26 trillion. The best estimate I could find of average daily dollar volume on the NYSE is about $30 billion. Corporate buybacks of their own stock continue to be a major factor in pushing the market higher by providing buying power and reducing the count of outstanding shares.

So there is a lot of good news. Against this, there are frequent warnings of a stock market crash. It’s hard for me to imagine a crash occurring when so many pundits are warning of one. I clearly recall that in 1987 everyone had Dow 3600 on the brain when it peaked at about 2700. In 2008, the conventional wisdom was that the mortgage crisis was “contained”; ie, confined to sub-prime mortgages. Few warnings then, lots now. This graphic of crash warnings versus stock prices is instructive:

Longer term, I see misplaced worry and misplaced complacency in different places. Many worry about an inverted yield curve; we do not. A lot of market observers have pointed out that an inverted yield curve often presages a recession. True. But not always. And there is a difference between correlation and causation. In times past, nominal rates were already high when the Fed raised short-term interest rates and indeed helped to engender an economic slowdown. But presently, short-term Treasury yields are still barely above the US core inflation rate which has fluctuated between 1.55% and 2.35% during the past five years. So short rates are not choking the economy.

There is another matter that gets very little attention while times are good. The Dodd-Frank reforms have taken away most of the authority that the Federal Reserve has had to lend to institutions with severe liquidity problems during periods of market stress. The senior regulators involved in the 2008 rescue efforts have expressed concern that without the ability to conduct bailouts – which are politically unpopular – we run the risk of a far worse economic outcome in the event of another market panic. Put another way, politicians seem more worried about pitchforks than about substantive economics. We may pay a steep price for that at some point.

For now, things are good. Our largest positions are Amazon, Apple (but about a third less than the index weight), AT&T (we locked in a 6.33% yield on most of the position in July), Wellcare, Google, Centene, and Microsoft. We also own a fair amount of Taiwan Semiconductor (TSM). Trade tensions have affected TSM a bit, but the valuation is reasonable and earnings and revenue are growing at a mid-teens clip with only a minimal blip in 2008-09.

We carefully review developments daily in all of our major holdings. Valuations in some of them are near historical highs. We can’t help but wonder why the CEO of Microsoft sold about a third of his stock in the company; the stock has continued higher since then. We are balancing our growth stock exposure with some of the deep value purchases noted earlier. We are concentrating portfolios a bit more given the influence of the mega-cap companies on key indexes, all while controlling risk as best we can. We are happy to discuss the economic outlook, the prospects for individual stocks, tax and financial planning, or whatever else with you at any time – please don’t hesitate to call or email whenever we can be helpful. Thank you for your continued confidence.

[1] https://seekingalpha.com/article/4207960-t-6-percent-yield-much