One way to serve clients is to stop others from disserving them. In space dedicated to providing ideas to help you and your clients handle money better, immediate and very certain gains are sometimes most easily obtained by illuminating scams and needless fees that are probably hurting you and those you know right now.

In the arena of investments, there are many schemes through which financial professionals fleece their customers. Some of the hits people take occur at certain moments, such as when a sales-charge loaded mutual fund or an annuity is purchased. Others occur on a continuous basis, bleeding assets day after day.

In fact, for the past several years, the major brokerage houses have been pushing their salespeople to “annuitize” their clientele. Instead of depending on sporadic episodes of service that generate commissions, brokers have come up with means to constantly charge clients whether or not service is actually rendered. One of the more perfidious creations is the wrap account.

Wrap accounts were created for a number of reasons — all of them detrimental to clients. Most important, wrap accounts provide a steady stream of income to brokers and the brokerage houses for which they work. Non-wrap accounts incur charges upon transactions. In addition to fostering volatile income patterns for the institution, non-wrap accounts often were abused by brokers who would encourage trades for the sake of commissions. Many firms have been sued by clients so abused. To help limit such abuse and suits — and yet to help keep a high flow of income — firms set up wrap accounts. Instead of charging for trades, an account is charged a set fee, commonly 1 percent to 3 percent of assets, usually with an annual minimum in the low thousands. Though often presented as an account with limitless trading, most wraps actually charge for transactions above a predetermined maximum. Meanwhile, if a wrap account experiences very little trading, no refund is provided.

Poor Vehicles

Wrap accounts create a natural windfall for brokers at the expense of clients. Offered by the high-cost major brokerages, a client is locked into paying high commissions whether or not trading actually occurs. Ironically, whereas regular brokerage accounts forced brokers to come up with investment ideas to induce trades, wrap accounts take away incentives to provide any help. As most brokers are simply salespeople without a shred of portfolio management acumen, this is probably a good thing. But without “service,” the wrap is more than just a rip-off for prepaid exorbitantly priced trades — it’s a mechanism for paying a lot for very little.

Last year, the U.S. Court of Appeals for the D.C. Circuit actually deemed wrap accounts based solely on annuitized commissions to be illegal. The court held that the firms charging these fees must be held to fiduciary standards consistent with the Investment Company Act of 1940.

In response, the major brokerages created “comprehensive” wrap accounts through which advice would be provided to fee paying clients. Unfortunately, these firms did not send tens of thousands of their salespeople to MBA programs or somehow transfer portfolio management experience to them through some massive Vulcan mind meld. The brochures are wordier, the reports more graphically intense and the jargon now laced with impressive terms. But the accounts are essentially the same, and the “advisers” and “consultants” proffering them are still salespeople.

Don’t wrap accounts entail investment management?

In and of themselves, they do not. If you want a competent financial professional to manage your assets, you should either invest in no-load mutual funds or with a registered investment adviser (RIA). Mutual funds and RIAs charge fees for the management of your assets. You do not need a salesperson to place your money with either.

Brokers who earn their money from wrap fees often will pass ideas from others to make it seem like they are adding investment management value. They may even work with you to put money in a mutual fund or with a consulting manager. At this point, the wrap fee acts like an annuitized mutual fund sales charge. Wrap fees have nothing to do with money management. True money managers charge a management fee, and the contract or prospectus will confirm that such charges are for portfolio management. Wrap fees go to salespeople.

The Real Cost

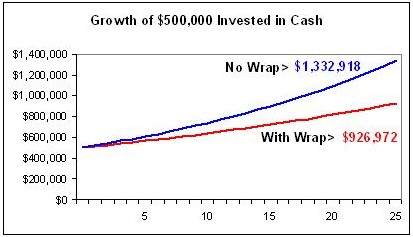

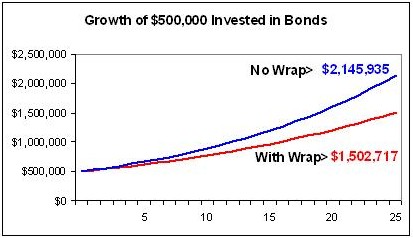

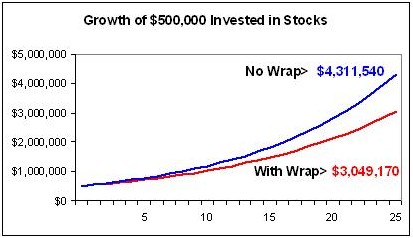

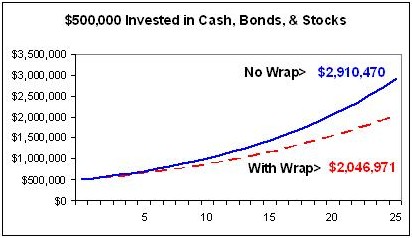

Merrill Lynch recently created a trust account wrap program with an annual charge of 1.75 percent of assets. Other wrap programs commonly charge between 1 percent and 3 percent. Using 1.5 percent as a conservative wrap rate and return rates of 4 percent, 6 percent and 9 percent on cash, bonds and stocks respectively, what is the impact of investing via a wrap?

As can be seen in the accompanying charts, the lost earnings are quite substantial. Over 25 years, on a $500,000 investment, wrap fees reduced cash earnings more than $400,000, bond earnings by nearly $650,000, stock growth by more than $1.2 million and a diversified portfolio of 50 percent stocks, 40 percent bonds and 10 percent cash by almost $900,000.

Over time, this wrap fee damaged returns more than 40 percent. Obviously, accounts with wrap fees of 1.75 percent or more are even more deleterious. A broker presenting an investment plan with the above assumptions would show a prospect that in a mixed portfolio the prospect’s half-million likely would grow to $2,046,971. It is an impressive number, and it might close the sale. What the broker would not show is that the same half-million invested in the same asset categories but through no-load mutual funds or RIA would likely grow to nearly $3 million.

And, in addition to training salespeople to talk like money managers, institutions smartly base wrap fees on assets. If the assets were being managed and the fee was designated for such, fine. But the actual service of the wrap account is merely an aggregation of assumed commissions — an accounting maneuver to force prepayment of high-cost trades. For this “benefit,” one is charged on all assets. Imagine hiring a plumber who bills you as a percentage of the value of your whole house and not for the work done.

The numbers, 1.5 percent, 1.75 percent, etc. sound innocuous, but when you realize that they’re netted out of returns that have historically fallen between 2 percent and 10 percent, their substantial impact becomes apparent.

What to do?

Simply put, if you have an account with a wrap arrangement, call your broker and get out of it. You will save money and grow assets at a higher rate the next day. If you trade enough so that the transaction costs at your institution are troubling, switch institutions. E-Trade, TD Ameritrade, Scottrade, Schwab and others offer platforms with trade costs under $20. If you would like investment guidance, talk to an RIA. Most important, stop dealing with your current broker. Wraps are barely legal and structurally damaging to client assets. Honest, competent financial professionals know such. Your broker decided to help himself at your expense. It’s time for you to help yourself – it’s your money.

This article was originally published in New Jersey Lawyer, July 2, 2008