Fixed Income

Investment Grade Fixed Income Strategy

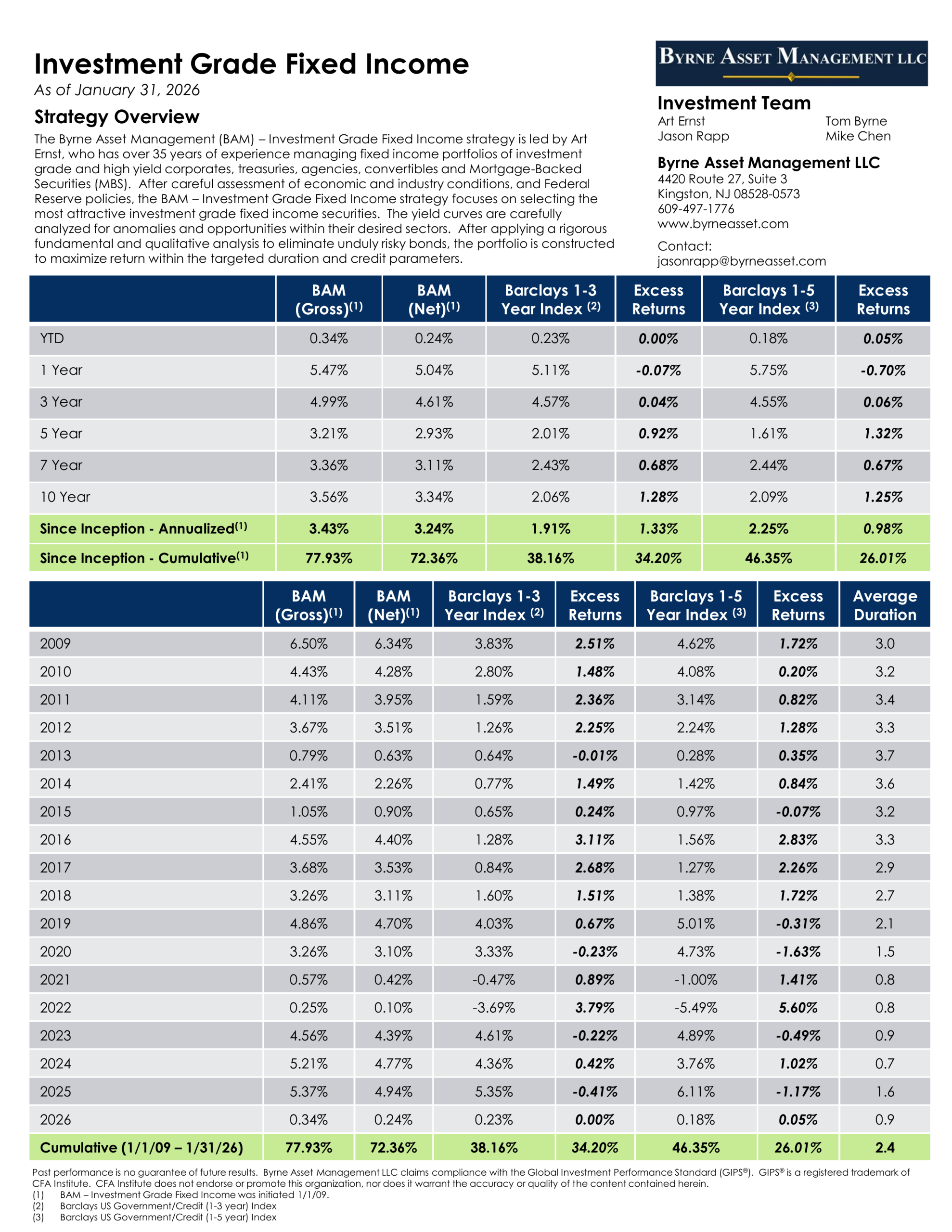

The Byrne Asset Management Investment Grade Fixed Income strategy is managed by Art Ernst, who has over 35 years of experience managing fixed income portfolios of investment grade and high yield corporates, treasuries, agencies, convertibles, and mortgage-backed securities. The strategy is designed to provide consistent income while preserving capital through disciplined security selection and prudent risk management.

Strategy Overview

Income generation

The strategy focuses on generating steady income with capital preservation as a core objective, seeking to provide consistent cash flows while managing downside risk.

Quality focus

Emphasis on investment grade securities including corporates, treasuries, agencies, and selectively utilizing mortgage-backed securities to enhance diversification and yield.

Targeted approach

Portfolios are constructed with optimized duration and credit selection to maximize return within carefully defined risk parameters and client objectives.

Byrne Asset Management is an SEC-registered, GIPS-compliant, employee-owned investment advisor headquartered in Kingston, New Jersey, with approximately $1.8 billion in total firm assets under management and assets under advisement.

Past performance is not a guarantee of future results.

Investment Process

After careful assessment of economic conditions, Federal Reserve policies, and yield curve dynamics, the BAM Investment Grade Fixed Income strategy focuses on selecting the most attractive investment grade fixed income securities. The process applies rigorous fundamental and qualitative analysis to eliminate unduly risky bonds, with portfolios constructed to maximize return within targeted duration and credit parameters.

Macro analysis

- Assessment of economic conditions and growth trends.

- Analysis of Federal Reserve policies and monetary stance.

- Evaluation of yield curve dynamics and term structure.

Security selection

- Rigorous fundamental analysis of issuer credit quality.

- Credit quality assessment and risk evaluation.

- Risk-adjusted return evaluation and relative value analysis.

Portfolio Construction

Fixed income portfolios are constructed to maximize return within carefully defined duration and credit parameters. The strategy focuses on investment grade securities including corporates, treasuries, agencies, and selectively utilizes mortgage-backed securities to enhance diversification and yield.

For complete details on our fixed income strategy, including current positioning, duration targets, credit quality distribution, and performance details, please download our institutional tear sheet or contact our investment team directly.

Investment Grade Fixed Income Investment Team

The Investment Grade Fixed Income strategy is managed by a four-person investment team led by COO and Head of Fixed Income Art Ernst. The team combines deep fixed income expertise with disciplined risk management, with incentives designed to align closely with long-term client outcomes.

Art Ernst

COO, Head of Fixed Income, CFP®

Art leads the Investment Grade Fixed Income strategy with over 35 years of experience managing portfolios of investment grade and high yield corporates, treasuries, agencies, convertibles, and mortgage-backed securities.

Tom Byrne

Chief Executive Officer

Founder and chief executive officer of Byrne Asset Management, responsible for overall firm leadership, governance, and client stewardship.

Jason Rapp

Portfolio Manager

Portfolio manager supporting the Investment Grade Fixed Income strategy, bringing experience across investment banking, hedge funds, and private equity to fundamental credit analysis.

Mike Chen

Analyst

Analyst focused on quantitative research, portfolio analytics, and risk management, supporting security selection and ongoing portfolio monitoring.

Strategy Resources

For complete information on our Investment Grade Fixed Income strategy, including current positioning, duration targets, credit quality distribution, and historical performance, please download our institutional presentation or contact our investment team.