Mildly put, this year has gotten off to an eventful start. The new administration has ushered in a range of policy changes that have created both hope and uncertainty. After two years of strong equity market performance, stocks had a rocky first quarter, as seen here:

Subsequent to the end of the quarter we have seen a significant increase in volatility, driven mostly by the announcement of the Trump administration’s reciprocal tariff programs, then subsequent spikes and ebbs in rhetoric and policy shifts.

Meanwhile, the bond market has been largely unchanged due to the countervailing effects of tariffs, which directly increase inflation while they augment the likelihood of a recession. Net, short-term rates and 30-year treasuries were unchanged while the yield on 10-year treasuries dipped slightly from 4.57% to 4.25% at the end of the quarter.

Economic Overview

After the initial euphoria exhibited in the markets with the election of a new administration and congress, economic indicators have exhibited a mixed picture. Despite much attention being paid to cuts in government spending that began in early February, led by the Department of Government Efficiency (DOGE) and the associated layoffs of federal workers, the overall unemployment rate has remained relatively constant, between 4% and 4.2% since November. But these figures do not yet fully reflect some of the government layoffs. Unemployment is a lagging indicator, like gross domestic product and price measures, it is a backward-looking statistic.

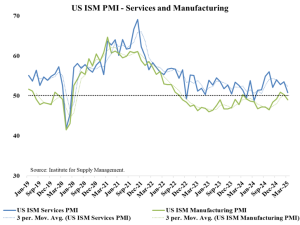

A well-known leading indicator of economic activity is the Institute for Supply Chain Management’s Purchasing Manager’s Index (PMI). At present, both the manufacturing and the services side of the economy are hovering around the 50 mark, which indicates a modest expansionary mode, consistent with the last few years.

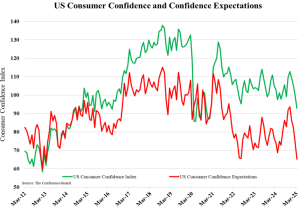

Another leading indicator is consumer confidence. Driven to a great extent by the uncertainty surrounding the administration’s tariff policies and the threat of higher inflation, confidence has dropped, both in terms of present conditions and expectations. Expectations are down to levels hit in the summer of 2022 at the peak of inflation, and back in early 2013 when economic growth was still anemic coming out of the Great Financial Recession and there was a temporary increase in the social security tax.

Disappointingly, inflation remains sticky. The most recent reading for the Personal Consumption Expenditures Index (PCE), the Federal Reserve’s preferred gauge, came in at +2.5% for the most recent month, which was a little above consensus expectations and above the Fed’s long-term target of 2%, but consistent with readings over the past year.

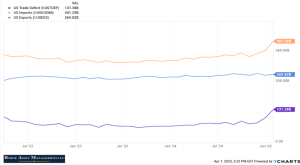

The Federal Reserve of Atlanta has a forecasting model that estimates US Gross Domestic Product (GDP) growth for the current quarter. This GDP model is currently forecasting a decline of -2.2% for the first quarter of 2025, which would indicate economic contraction. However, that negative estimate is almost entirely due to our trade imbalance. GDP adds exports and subtracts imports in its calculations.

In anticipation of upcoming tariffs being implemented, businesses have significantly increased their imports in recent weeks. Excluding the jump in imports, economic activity has still softened a little, but its pace remains largely consistent with quarters of the recent past. In the chart below you can see the spike in imports and steady exports, resulting in the also-evident lift in the trade deficit.

It is interesting to note that the United States economy is less dependent on international trade than most of the leading economies, as evidenced by the percentages seen in the chart below:

Note that the higher percentages for European countries are partly due to their trade within Europe. It is also important to point out how significant trade between the U.S. and Canada is in aggregate terms, but in particular as a percentage of the Canadian economy. Still, though the U.S. is less dependent, we are not insulated, especially with regard to trade’s impact on the supply chain.

Taking all of these factors together, the Federal Reserve is likely to cut short-term interest rates slightly this year, though this may not impact long-term rates. The economy is more apt to grow than not, though the chance of a recession seems much higher than it did only a few months ago. Briefly, there is much uncertainty, in particular with respect to tariff policy, which can change quickly. The magnitude and timing of policy changes will be critical. The higher and sooner the increases, the worse the impact. Delays and reductions lessen the pace. If negotiations result in reductions of long-existing tariffs and other trade impediments here and abroad, there could be an outcome that is positive for growth, prices, rates and markets.

Markets

After two years of strong market performance, stocks pulled back in the first quarter. The Magnificent 8 large technology-oriented companies that led much of the performance in the prior two years saw their share prices retreat. Small- and mid-cap stocks, which have significantly trailed their large-cap peers over the past couple of years, continued to underperform, despite hopes that the new administration would provide a more favorable regulatory and business environment for smaller and mid-sized domestically oriented companies.

With the pullback in the market, the S&P 500’s valuations are presently in line with long term historical averages, whereas mid-cap and small-cap companies are now trading below their historical norms.

Within bond and balanced accounts, we continue to emphasize a healthy combination of stability, yield, and liquidity. We have avoided new purchases of corporate bonds partly due to lack of value (“tight spreads” in bond trading parlance) and partly due to potentially deteriorating credit. Meanwhile, in addition to offering great liquidity, treasuries and agencies provide income that is exempt from state income taxes. Whether wanted for rebalancing into newly cheaper stocks or for repositioning into more gainful fixed income instruments when conditions dictate such is propitious, we will be ready.

As always, if you or any family members or friends have any questions or need advice on any financial matter, we are always available.

Once again, we thank you for the opportunity to serve.