U.S. Small Cap

U.S. Small Cap Strategy

The Byrne Asset Management U.S. Small Cap strategy is a long-only, high-conviction portfolio of U.S. small cap stocks managed by Head of Institutional Equities Brian Arena, former head of U.S. equities for the State of New Jersey, Division of Investment. The strategy is designed to deliver attractive long-term returns while maintaining clear small cap purity and diversified sector exposure.

Strategy Overview

Performance focus

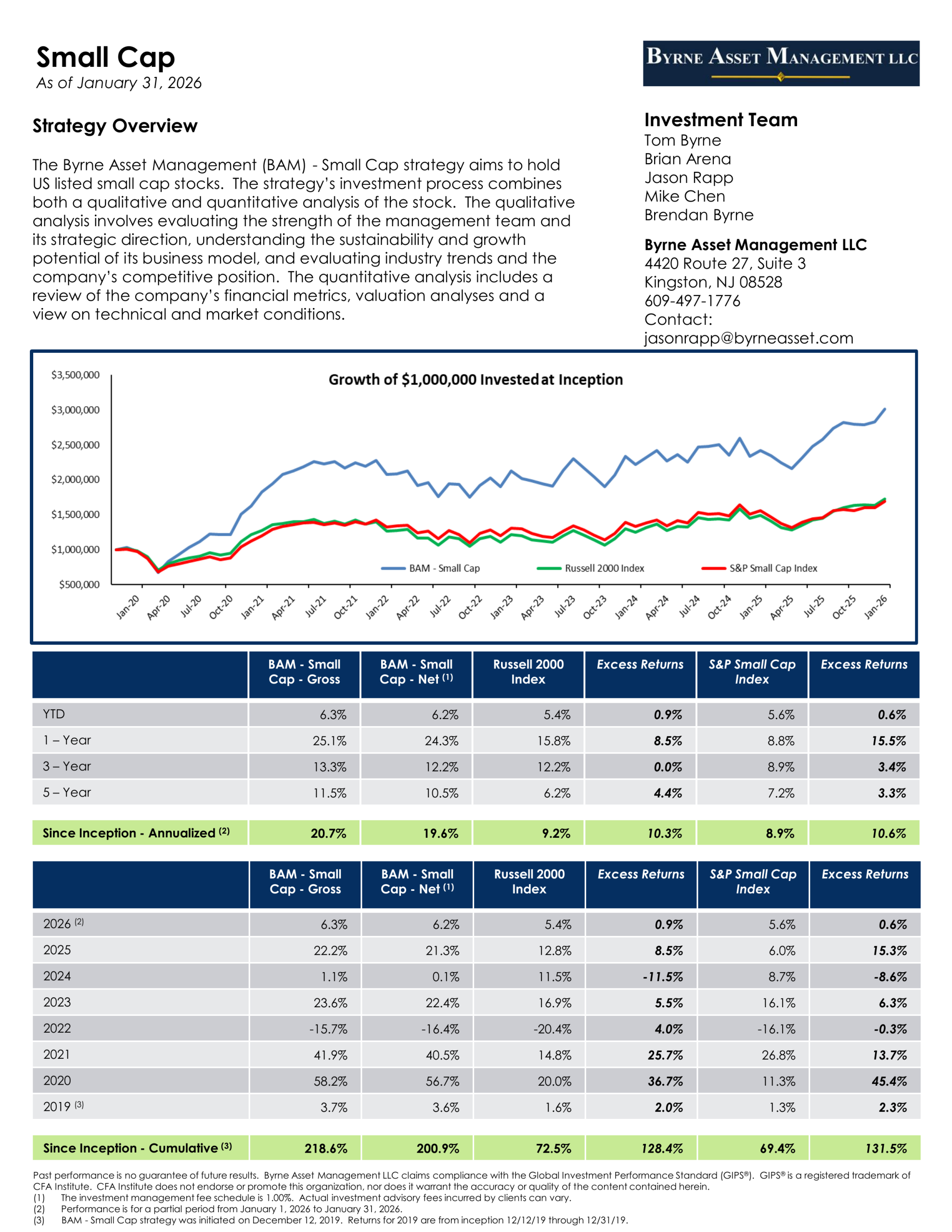

Since inception in December 2019, the U.S. Small Cap strategy has generated an annualized net return of 19.4% compared to 8.4% for the Russell 2000 Index and 8.1% for the S&P Small Cap Index (as of September 30, 2025).

Portfolio construction

Long-only, high-alpha portfolio of approximately 85 stocks with diversified sector exposure, high active share (around 97% since inception), and a persistent focus on fundamental stock selection.

Small cap purity

Weighted average market cap of approximately $3.6 billion and median market cap of roughly $1.9 billion, reflecting a deliberate commitment to the small cap universe.

Byrne Asset Management is an SEC-registered, GIPS-compliant, employee-owned investment advisor headquartered in Kingston, New Jersey, with approximately $1.8 billion in total firm assets under management and assets under advisement.

Past performance is not a guarantee of future results.

Zephyr PSN Recognition

Within Zephyr PSN’s U.S. Small Cap Core and U.S. Small Cap Growth universes, the Byrne Asset Management U.S. Small Cap Core strategy ranks in the top percentile versus peers for both the five-year period and since inception in December 2019.

In the U.S. Small Cap Value universe, the strategy ranks in the 11th percentile for the five-year period and in the top percentile since inception.

Period ended September 30, 2025. Rankings are based on manager-reported composite results within Zephyr PSN’s peer universes and methodology and do not represent an endorsement or recommendation by Zephyr or PSN. Past performance is not a guarantee of future results.

Investment Process

The BAM U.S. Small Cap strategy holds U.S.-listed small cap stocks and combines rigorous fundamental research with a disciplined portfolio construction framework. The team blends qualitative and quantitative analysis to identify companies with durable business models, aligned management teams, and attractive valuations, while actively managing risk at the position, sector, and portfolio levels.

Qualitative analysis

- Evaluating the strength, alignment, and track record of management teams and boards.

- Assessing the sustainability, competitive positioning, and growth potential of each business model.

- Understanding industry structure, secular trends, and each company’s competitive moat.

Quantitative analysis

- Reviewing balance sheet quality, cash flow durability, and return on capital metrics.

- Conducting valuation work, including scenario analysis and downside risk assessment.

- Monitoring technical and market conditions to help inform position sizing and risk management.

U.S. Small Cap Investment Team

The U.S. Small Cap strategy is managed by a five-person investment team led by Senior Portfolio Manager Brian Arena. Byrne’s focus with this strategy is performance generation, not asset gathering, and the team’s incentives are designed to align closely with client outcomes.

Brian Arena

Senior Portfolio Manager, U.S. Small Cap

Previously managed the $30 billion U.S. Equity Portfolio and the $2.5 billion New Jersey Small Stock Portfolio at the State of New Jersey, Division of Investment. Brian leads the U.S. Small Cap investment team.

Tom Byrne

Chief Executive Officer

Founder and chief executive officer of Byrne Asset Management, responsible for overall firm leadership, governance, and client stewardship.

Jason Rapp

Portfolio Manager

Portfolio manager on the U.S. Small Cap strategy, bringing experience across investment banking, hedge funds, and private equity to fundamental company research.

Mike Chen

Analyst

Analyst focused on quantitative research, portfolio analytics, and risk management, supporting idea generation and ongoing monitoring.

Brendan Byrne

Analyst

Analyst responsible for fundamental company research, competitive analysis, and supporting client and consultant communications for the U.S. Small Cap strategy.

Strategy Resources

For complete performance details, portfolio characteristics, and additional information on our U.S. Small Cap strategy, please download our institutional presentation or contact our investment team.