In terms of the markets, the first two quarters of 2022 were certainly periods one would like to forget. Equity markets recorded their worst first half performance in over 50 years. The bond market, which usually provides respite during volatile times, also saw broad-based declines as interest rates rose. The S&P 500 Index declined 20.0% in the first half while the Nasdaq Composite was down 29.2%. On the fixed income side, the Barclays Aggregate Bond Index, a broad benchmark for investment grade bonds within the United States, was down 10.4%.

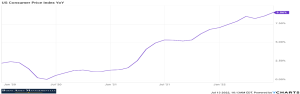

War and pestilence aside, the market’s primary focus this year has been on inflation, and how the Federal Reserve would respond. As seen in the chart below, inflation as measured by the US Consumer Price Index had remained at modest levels through the pandemic, but started rising meaningfully in the second half of 2021.

To help combat these inflationary pressures, the Federal Reserve has started to raise interest rates, most directly by increasing the Federal Funds Rate, the rate it charges banks for overnight borrowing. Changes in the Fed Funds rate usually reverberate to other loans and fixed income instruments worldwide. The Fed increased the funds rate by 0.25% in March, 0.50% in May and 0.75% in June. The question is, how effective will these changes be in moderating inflationary pressures, and can this moderation be achieved without also causing a severe drop-off in economic activity? This dynamic will likely drive the equity markets, in the near future.

Many would argue that the response from the Federal Reserve has been too late and too slow. For instance, though total Fed rate increases so far amount to 1.5%, 30-year mortgage rates basically doubled from about 3% in late 2021 to around 6% in late June while 2-year treasuries rose from under 1% to over 3%. Bond and stock market participants may have been signaling that the Fed has not done enough, that rates need to go up further, and faster.

Critically, much recent inflation is due to temporary supply chain challenges caused by the pandemic and more recently the war in Ukraine, while only some is likely due to traditional factors such as monetary policy. Further, CPI is a lagging indicator of inflation. More important is its future trajectory, and, of course, economic growth.

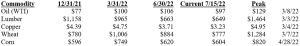

Oil prices have been in focus of late. Commodity prices in general have seen dramatic moves this year. Below are recent prices for some often viewed as proxies for energy, construction, industrial production, and food.

These leading commodity input prices appear to have peaked in the March/April timeframe. As opposed to increasing inflation, their decline suggests that CPI readings may also be near their peak.

The bond market also seems to suggest that inflationary pressures will wane. The chart below shows how the yields on the benchmark 2-year, 10-year and 30-year US treasuries have changed so far this year.

As you can see, rates rose much, but they may also have hit a peak in mid-June.

While this was certainly a rough start to the year, it is important to put things into a long-term context and realize that we have been through many stock market pullbacks over the years. This is the 13th decline of more than 20% since World War II. During the Covid lockdown-induced recession in 2020, the S&P 500 declined 31.8% from its pre-pandemic peak on February 19, 2020, to its bottom on March 23, 2020, only to rally subsequently.

Consider the “lost decade” of the 1970s, a time many now point to as a corollary. It was a period marked by multiple recessions, high inflation, energy crises, political turmoil and general malaise. The S&P 500 still returned 6.2% annually over the whole decade. While this was below its long-term (1913-2022) average of 10.1% (or 6.7% annually above the rate of inflation), it does suggest that equities remain one of the better areas for long-term investment, even during inflationary periods.

In times good and bad, we look to execute positive actions. For instance, we can rebalance on tactical and strategic levels. If the long-term outlook for certain holdings is unchanged while price movements are disparate, we can trim from the relatively higher priced securities and add to those now unduly lower. For instance, though bonds declined, they did not decline nearly as much as stocks. In balanced accounts, at a strategic level, we sold bond holdings and added to stocks. Tactically, within the fixed income portfolio, we shifted on the margins from relatively unchanged low yielding ETFs into high-yielding floating-rate closed end funds whose prices declined inordinately in sympathy with stocks. Among equities, we did similar minor adjustments upon opportunity.

Going forward, we note that the S&P 500 is currently trading at less than 16 times its forward price to earnings ratio, well within its historical norms. This suggests that valuation levels, which had been somewhat stretched towards the end of last year, are much more attractive now. In fixed income, with rates now more attractive than since well before Covid, we will imminently return to building up portfolios of individual bonds. This will add much stability to the overall portfolio. In the long run, we want growth. But recent times remind us of the additional goal of capital preservation.

Indeed, volatile periods like we just experienced bring about heightened awareness of risk, its relation to reward, and consideration of different approaches and tactics.