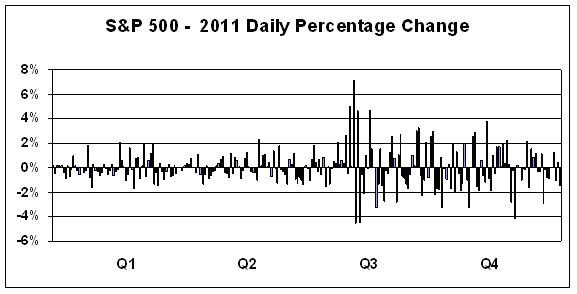

This year truly was a roller-coaster – an unnerving ride that ended up almost exactly where it began. The news from Europe mattered more than news from individual companies. The European debt crisis produced a lot of volatility, particularly after July. The chart at the end of this letter starkly illustrates this. Risk-adjusted returns mattered at least as much as absolute returns. Since risk controls were particularly important, we had one foot on the brake pedal for much of the second half of the year. This kept your account less volatile than the overall market. We lost less than most when the market dropped sharply in late summer, but this approach also capped our upside during the sudden upturn in October. We put capital preservation first, but also reversed faster than many to catch much (though not all) of the rebound in October. It was also a year in which good dividend yields mattered more than most other measures of value, and we focused there as well. Diversification into Asia did not help; most Asian markets declined by double digit percentages. It was the worst year for active managers in over a decade, and so I’m proud that we did as well as we did relative to most other managers and mutual funds.

It was a better year for blue chip stocks than for the broader market; certainly not a year in which incremental risk was rewarded. Among the major indices, only the Dow Industrials were up, gaining 5.5%. The S&P 500 Index was unchanged; it began the year at 1257.64 and ended it at 1257.60. Thanks to dividends, its total return was 2.1%. The Nasdaq fell from 2652.87 to 2505.15, a loss of 5.6%, and the broader market as measured by the Russell 2000 Index fell by 5.5%. Your account was down by 0.2%.

Though we sought and achieved lower volatility, we certainly looked for growth as well. There is nothing more fun than finding a stock that doubles or triples or more. But those situations were extremely rare this year. Apple remains a big position, and the stock returned 25.5% in 2011. But the passing of Steve Jobs created some doubts about the company’s ability to maintain its torrid pace of innovation and growth, and the stock stalled and made its high for the year in early October. Our most aggressive bet on continued growth is in Amazon. According to Morningstar, the company has grown earnings at over 50% compounded over the last five years. But it must keep up a pace of nearly 40% earnings growth in order to produce solid investment returns. Based on consistently strong revenue growth, the company should be able to achieve this. But there is more downside risk than usual in this stock, and I will cut the position accordingly if it falters.

The underlying tension remains the same. Stocks are cheap relative to current earnings, and all the fears outlined below are reflected in current prices. Still the fear of an enormous economic drag caused by too much debt, both in Europe and here, has caused CEOs and money managers and individuals to hold back from substantial new investments. The indebtedness, whether in Europe or Washington, creates a headwind that is very hard to quantify. And the debate rages about whether we need to incur even more debt in the short term to stimulate the growth we need to work our way out of the debt mess. There is the risk of a somewhat self-fulfilling downward spiral. As noted money manager Jeremy Grantham recently observed, the United States has become fundamentally uncompetitive because of depleted infrastructure, ineffective education and ineffective governance.

Europe is in even worse shape. There is a Catch-22. If a country like Greece leaves or gets kicked out of the Euro, it would likely trigger bank runs. People would want their money out of Greek banks before their accounts are converted from Euros to less valuable drachmas. But if Europe hangs together, it increases the risk of a default by a member nation. Needless to say, that would not be good for banks either. One way, they lose deposits. The other way, they take huge losses on their investments. Hence the mess.

However, history has shown that previous debt crises have been great buying opportunities if properly timed. Most notably, the start of the 1982 bull market occurred during the height of the Mexican debt crisis. Furthermore, even in bad economic times, there are always some attractive investment opportunities, and we have done relatively well in finding them. Some of these investments are a hedge against our structural economic problems. For instance, we have maintained a position in gold because governments will probably continue to print money to lessen debt burdens. When you print more money, it debases the value of existing currency. When currency becomes less valuable, it takes more of that currency to buy a given amount of gold. So we own gold. We own some gold stocks because they had gotten quite cheap relative to the value of the metal itself. Gold tends to rise as the dollar declines, and to decline as the dollar rises. So gold has weakened a bit in recent weeks as the dollar has strengthened relative to the Euro. Gold was a great addition to the portfolio this year, as well as a useful instrument of diversification, but it was a net detractor from performance in the fourth quarter. Gold gained 9.6% for the year, but lost 3.8% in the final quarter as the European mess gave rise to a weaker Euro / stronger dollar. While the prospect of deflation remains a risk to gold prices, gold should stay strong as long as governments continue to print more money to fight deflationary forces and to make it easier to pay down debt. Goldman Sachs sees gold at $1,940 by the end of 2012 (versus $1,566 at year-end).

Yet gold offers no yield, and is not a sure way to generate investment income. So after gold and a few growth plays like Apple and Amazon, we focused a lot on yield. Some stocks provided both a good yield and appreciation. For instance, Intel gained 13.6% in the fourth quarter and has a dividend yield of 3.4%. But we’ve owned Intel for awhile and it took longer to start moving up than I had hoped (and rationally expected). The focus on dividend yield helped to cushion our portfolio especially during market declines and added to total return. So the mix of utility and telecomm stocks, pipeline companies and decent yielding blue chips such as Intel produced a respectable year.

Your portfolio is rationally constructed and well-diversified with attractively valued stocks. Let’s review some of the major positions. General Electric stock has gone from way overvalued a decade ago to quite undervalued today. I think investors are afraid of a repeat of 2008, but GE has built a huge cash position since then and a recent dividend boost put the yield (briefly) at over 4%. Value Line says the industrial side of the business has a record backlog of orders, and the company will gain much business from development in emerging markets. Apple’s price reflects a tense stalemate; there is concern about long term prospects with Steve Jobs departed. But it has doubled earnings in each of the past two years, and yet trades at a PE ratio of only 11.5 – a cheaper valuation than at the depth of the financial crisis. Either earnings growth has to drastically slow, or the stock has to rise. Oil stocks such as Chevron and Exxon had their PE ratios fall by about one-third this year; fears of an economic slowdown hit energy stocks harder than the overall market. But Goldman Sachs is predicting $113-120 oil by mid-2012. Moreover, these stocks have very good dividend yields, and are quite cheap as indicated by the following chart showing the PE ratio at year-end for Chevron:

| FY | Earnings | Close | PE |

|---|---|---|---|

| 2004 | 6.28 | 54.40 | 8.7 |

| 2005 | 6.54 | 59.38 | 9.1 |

| 2006 | 7.80 | 72.88 | 9.3 |

| 2007 | 8.77 | 83.25 | 9.5 |

| 2008 | 11.67 | 70.52 | 6.0 |

| 2009 | 5.24 | 72.12 | 13.8 |

| 2010 | 9.48 | 91.25 | 9.6 |

| 2011 | 14.40 | 100.86 | 7.0 |

Average PE ratio 9.1 / Price in event of reversion to mean PE 131.35

IBM has achieved earnings growth in the low double digits, and remains stable in a volatile environment. It returned 27% last year. Celgene is on the cutting edge of the treatment of lung and blood cancers, and is growing in other areas as well. Although the stock has a fairly high PE ratio, it is reasonably priced given its earnings growth. The stock returned 14.3% for the year. Oracle has managed steady earnings growth, even in bad years like 2003 and 2009, so a mild earnings shortfall caused a recent sharp decline in the stock. Oracle has a low PEG (PE to earnings growth) ratio. It has a minimal dividend yield, but is generally more stable and steady than most tech stocks. The iShares Nasdaq Biotechnology ETF (symbol IBB) is an optimal way to gain exposure to the biotech sector, which is the cutting edge in health care. The IBB appreciated by 11.8% for the quarter and about the same for the full year. Verizon gained 9% in the fourth quarter and 17.6% for the year, aided by its attractive 5.2% dividend yield. We also own a number of electric utilities with solid yields. The US strongly outperformed most foreign stock markets this year. For instance, the Shanghai market was down 22% and the MSCI Emerging Markets index was down 20%. Although this really hurt our overall results this year, I think it remains important to be diversified internationally. We have done so primarily with the Mathews Pacific Tiger Fund (MAPTX), which has a great long term record, including outperformance of most Asian markets this year. Asia remains the global economic engine, and despite this year’s frustrating (11.4%) return, it makes sense to maintain exposure through this fund particularly now that most Asian markets are pretty cheap.

There were certainly some disappointing trades this quarter. I may have jumped the gun on owning at least some bank stocks; we’ll see. The oil refining stocks were disappointing. They have been cheap relative to estimated earnings, but refining margins declined during the quarter, earnings estimates followed lower, and the stocks followed suit.

So what do we conclude?

There are certainly reasons to be concerned as we move into 2012. Italy is on the front lines of the European crisis, and it has a very front-loaded debt structure with €306 billion to be refinanced in 2012 – €113 billion of that in the first quarter. Even so, the Bank of International Settlements has recently issued an optimistic assessment of Italy’s ability to address its debt problems. On the other hand, the IMF’s Christine Lagarde warned of a 1930s outcome if European leaders dithered too long.

There are also plenty of reasons to be optimistic. We are doing well enough if we can avoid Europe dragging us down. Corporate profits are good and balance sheets are strong. Valuations are quite cheap. The Fed is determined to do whatever it can to stimulate the domestic economy. Home sales have begun to rise. Consumer confidence has jumped recently. Unemployment claims are at a post-2008 low. Opportunities always pop up; we’ll do our best to find them. Thanks so much for your continued confidence.

With all good wishes for the New Year…

* Past performance is not necessarily indicative of future performance. Results for individual clients may vary. Results are not audited. Byrne Asset numbers include all actively managed equity accounts and reflect the reinvestment of dividends and deduction of all fees.