Our brochure

View Our Brochure as Filed with the SEC

Institutional sophistication. Individual attention.

View Our Brochure as Filed with the SEC

It is hard to get through an hour of commercial television without seeing a celebrity promote reverse mortgages as means to a better life for seniors. Far from life enhancing, these loans destroy wealth, providing gullible victims with modest cash amounts as

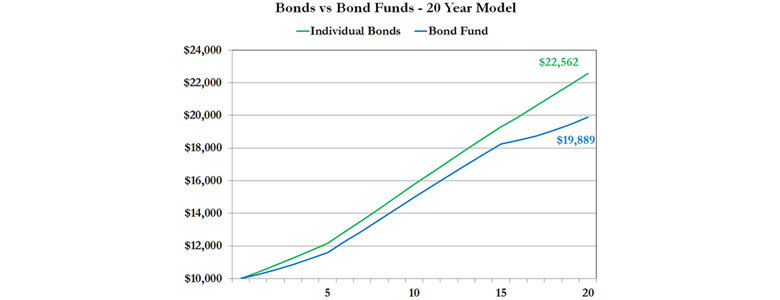

The adage that there is no free lunch is quite germane in the realm of fixed income investments: the greater the return, the greater the risk. With money market accounts yielding next to nothing, 5-year treasury bonds offering about 2%, and bank

The financial reform bill now under consideration in Congress may or may not pass. But already, the folks in DC made the task of obtaining good financial help easier. Under pressure from brokers and insurers who contribute much to political campaigns, the

Last month I flew to Ireland to help my daughter move back from Trinity College in Dublin. Taking advantage of roads and hotels emptied by the current economic slump, we spent about two weeks exploring the cities and countryside. The scenic vistas,

Last month I flew to Ireland to help my daughter move back from Trinity College in Dublin. Taking advantage of roads and hotels emptied by the current economic slump, we spent about two weeks exploring the cities and countryside. The scenic vistas,

Despite recent strength in the stock market, last year’s crash has pushed many investors to seek returns in other sectors. The massive flight of capital to the safest of vehicles, treasury bills and money market funds, has rendered paltry rates of returns;

A few weeks ago, the article I had planned for this space did not include a question mark. President Obama was newly installed in a worldwide aura of goodwill and hope. Soon after the inauguration, most of us expected to hear speeches

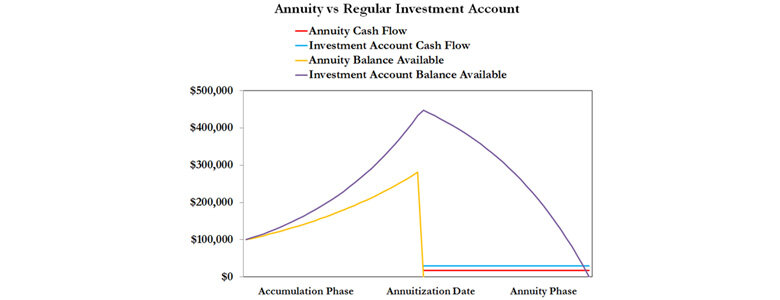

A frequently aired commercial for a large insurance company presents an 800-pound gorilla, a common metaphor for a hugely important issue somehow often ignored. The gorilla in the ad is looming retirement. Annuities, championed as a source of “guaranteed income for life,”

As of this writing, the Standard & Poor’s 500 is down over 45% from its peak 15 months ago; bond prices of esteemed corporate issuers indicate distress; and there is fear that the entire financial system is in peril. We have weathered