Given the pace of change and market volatility we thought it prudent to give you another update.

Importantly, over time we have been through many crises. Economic cycles, wars, terrorist attacks, oil embargos, and even previous disease outbreaks have caused distress in the financial markets. The current situation seems to have surprised everyone in terms of pace: the pace of the spread of the disease; the pace of information flow in our increasingly connected world; and the pace in which news affects stocks and bonds.

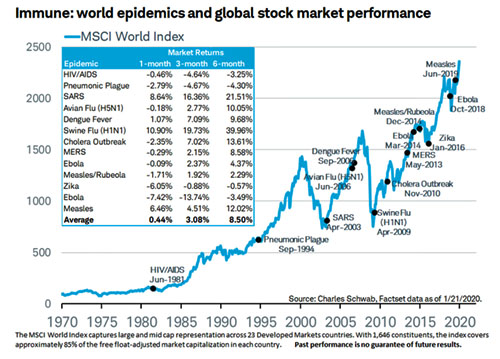

In an effort to help us understand the current crisis we have looked at past epidemics and their impact on the market and economy. The chart below highlights the major world epidemics that we have had in the last 50 years as well as global stock market performances.

COVID-19 seems to be of much greater concern than prior episodes, in part because of the much faster and extensive spread. The stock market, after initially shrugging off initial reports, has reacted violently. There is obviously the concern about the health impact, but the focus seems to be increasingly shifting to the actual economic impact from cancellations and closings, as well as short term liquidity needs. To abate the latter, the Federal Reserve has reduced interest rates and executed several measures aimed at making sure there is ample liquidity in the market.

Moreover, there have been a number of actions that could potentially add meaningful stimulus to the economy. There is discussion and likely implementation of a variety of tax cuts including payroll tax holidays. Gas prices will be much lower due to the recent collapse in oil prices. And there will likely be a rebound in demand when people return to work, events are rescheduled and things “return to normal”.

We are also encouraged by the belated success of social distancing in China and Korea, which led to a drastic slowdown in the spread of the virus in those places. We hope the social distancing and the rapid advancement of medicine will lead to similar success here. While we cannot predict, there is certainly at least a chance of a shock rebound in stock prices should events play out this way.

In the interim the market will likely continue to be very volatile and news reports on COVID-19 cases will most likely get worse. In our history, markets have always come back but it is difficult to predict within what time frame.

As we have discussed in the past, asset allocation is a key way to structure your portfolio to account for risk tolerance. For those with purely stock accounts we have nonetheless raised some cash out of prudence. In so doing, we realize that any given sale could be at an inopportune time but still consistent with the goal of capital preservation. But it has kept losses to less than would have occurred with purely indexed money. For those with balanced accounts the decline in stocks has brought a natural mathematical shift in percentage terms toward bonds and stability. We have also allowed cash from interest and dividends to accumulate.

We hope the probabilities above come into sharper focus in the near term. Meanwhile, we are doing our best to serve you well and know that frequent communication with you can only be helpful. Please don’t hesitate to reach out at any time.