The S&P 500 peaked at a record 4536.95 on September 2. But chaos in Washington and troubles in China have put a cap on stock prices, at least for the moment. The S&P 500 was barely positive for the quarter but is up 15.9% in total return terms for the year at quarter end. Indices such as the Nasdaq and Russell 2000 Index were lower for the quarter. We were up a fraction of a percent for the quarter.

The stock market has only had one down year in the past decade. Can the bull market remain intact? Interest rates and inflation are the key variables. As long as rates are low, corporations can borrow inexpensively. More significantly, low rates enable investors to apply a minimal discount to future earnings, resulting in a higher net present value of future earnings and justifying high valuations. This valuation of future earnings helps to explain why the PE ratio for the “growth” sector of the market is 1.75x higher than the PE for “value” stocks – the widest gap in over 20 years.

At the end of the quarter, the so-called forward PE ratio for the S&P 500 stocks was 19.6[1] using estimated earnings of $220 for 2022. That translates to an earnings yield of 5.11% – well above the 1.51% yield on ten-year Treasury securities. The difference renders an equity risk premium of 3.60% (or 360 basis points) using the 2022 earnings estimates.

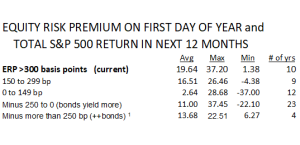

While history is only a guidepost and certainly not a guarantor of future developments, a scan of the last 60 years suggests that when the equity risk premium is above 300 basis points, it tends to be a healthy environment for stocks. (The forward P/E of the S&P 500 has been fluctuating in a flat range roughly between 20.0 and 23.0 since the end of April 2020. That’s almost as high as the valuation multiple prior to the bursting of the tech bubble in 2000.)

It would be nice if the chart below were the end of the story, but the investing world is never that simple. Here is a quick summary of what we found:

The level of interest rates and inflation rates factor into the equation, and the direction of these rates also matters. Rates on ten-year Treasury securities have risen from about 1% to 1.5% since the beginning of the year. A continued rise is likely to trim the valuations of growth stocks.

There is considerable risk of a rise in interest rates. As politicians dance closer to the edge of a default on government debt, the perception of credit deterioration could contribute to a rise in rates. Too much government borrowing and spending could also put pressure on rates. More generally, rates should not remain below the level of inflation indefinitely. The current debate about inflation is whether the recent elevated readings are “transitory” or something more permanent. Fed Chairman Powell has opined that it is a transitory problem due to Covid-related supply chain disruptions, but he has recently intimated that “transitory” might last longer than currently assumed.

Some analysts are concerned that if inflation turns out to be more persistent, the Fed could be behind the curve in controlling it. With so many help wanted signs, we could be in for some wage inflation. And things such as gasoline, airfares, and many items of clothing have risen as the nation rebounds from Covid.

Inflation had been running at an annual rate of about 1.4% at the start of the year. The most recent Consumer Price Index had a 5.4% year-over-year gain, but other inflation measures were lower. Even so, if inflation were to stay at or near this level, investors in ten-year Treasuries would be losing money in real terms. And so might stock investors. (You might ask why the market did so well in years when the equity risk premium was so unfavorable to stocks. Those readings are heavily skewed by years like 1982 and 1985 when interest rates were very high. But falling quite quickly. The market returned 22.5% in 1982 as the bull market launched that August, and it rose another 18.47% in the wake of the Plaza Accords of 1985 – year when the ten-year Treasury yield fell from 11 ½ to 9 percent.)

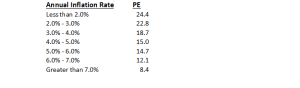

Goldman’s long-time stock maven Abby Joseph Cohen put together historical data showing US PE multiples at various levels of inflation. The monthly data, from January 1960 through May 2021, is rather sobering:

A compression of the forward PE ratio from 19.6 to 15, taken in a vacuum, would indicate a price decline of nearly 25 percent. Of course, some of that would be offset in total return terms by dividend income. Presumably even more of it would be offset by continued earnings growth. Higher rates can be good for certain stocks, such as banks that benefit from the higher lending margins that come with higher rates.

Another factor adversely affecting markets for the moment is the prospect of higher capital gains taxes in the future. Some investors may be taking some profits now in order to have their gains taxed at a lower rate. This is probably responsible for some of the selling pressure we’ve seen in September. In a related matter, tax law changes may make this the last year in which you can convert an IRA into a Roth IRA.

One major wildcard in world affairs is what seems to be a changing attitude in China toward capitalism. China today has more billionaires than the US. The government seems to be increasingly wary of their power. Both Alibaba and Tencent have recently made $15.5 billion “contributions” to “social equity funds” in China. It raises the question of whether capitalist shareholders will share in much of the earnings of these companies going forward. As a consequence, their share prices have suffered. China appears to be taking other steps to de-couple from the West, such as limiting the instruction of English to schoolchildren.

Interestingly, one benefit to the U.S. economy of both the Covid supply chain issues and the policy shifts in China is that major US companies will limit their reliance on outsourcing of critical supplies. This should result in more manufacturing facilities here in the US – good for the industrial sector – and more good-paying jobs.

September was a reminder that stocks can indeed go down. But we are invested in good companies with strong records of growth and/or solid and reliable dividends. We have tilted slightly more toward value stocks as opposed to growth stocks in recent weeks. Hopefully the market calms somewhat once the politicians stop playing chicken on the debt ceiling issue.